The Indian equities market is a quick-moving, high-risk environment where options traders may achieve substantial gains. Yet negotiating this market calls for expertise, experience, and cautious judgments. Regrettably, a lot of traders make easy mistakes that can cost them a lot of money. These errors whether it’s entering the market without a strategy, ignoring volatility, […]

While algorithmic trading offers several advantages, including greater efficiency, quicker trade execution, and cheaper transaction costs, it has also come under fire for a variety of reasons. Some of the reasons why it is considered unethical include: In conclusion, algorithmic trading may have numerous advantages, but we must also consider the possible risks it poses […]

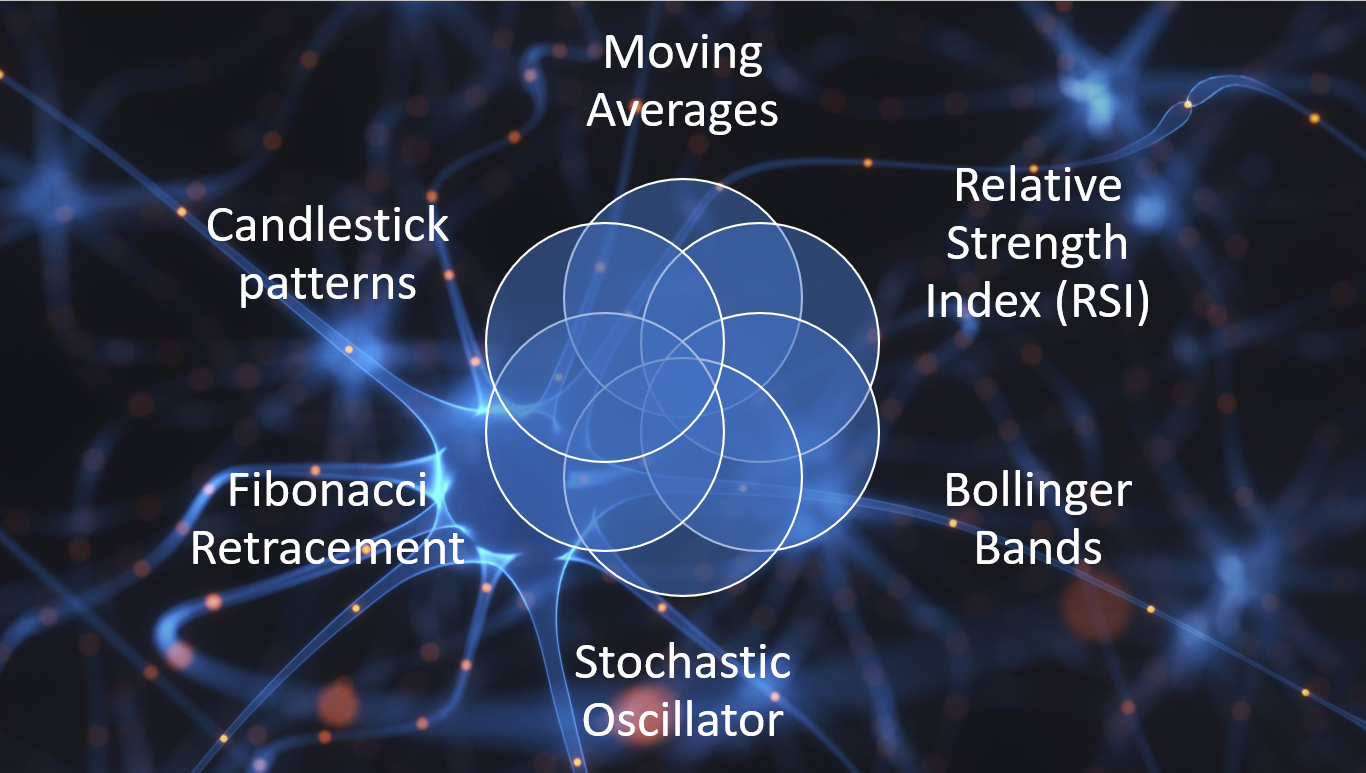

There is no one “best” technical indicator as different indicators may be more or less effective depending on the specific market conditions, the type of asset being traded, and the trader’s individual strategy and risk tolerance. However, some of the most commonly used technical indicators among traders include: In essence, it is worth mentioning that […]

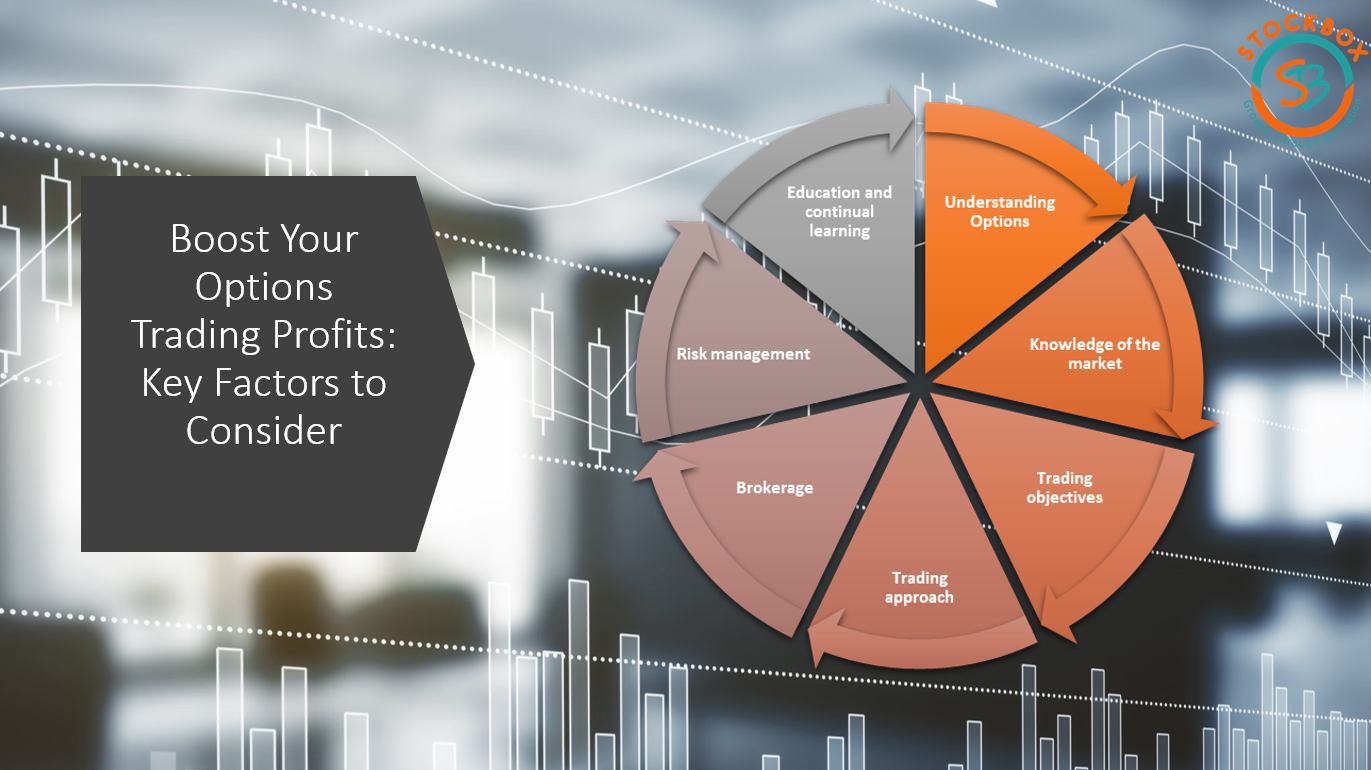

Before diving into the fascinating journey of options trading and improving the chances of success, it is crucial to take into account several vital aspects. These factors can help traders to enhance their probability of success in options trading. These factors are: In conclusion, it is critical to have a thorough grasp of options, financial […]

These days the market is flooded with a pretty casual slang known as “sure shot call”. Whether it be Instagram or telegram, you must have witnessed hundreds of channels giving these calls and guaranteeing a fortune. Sure shot call refers to a lucrative transaction or investment opportunity normally provided by shady channels or platforms in […]

Aluminium: the lightweight metal with heavyweight potential in the commodity market, is amongst the most frequently used metals which are being traded as a commodity on many international marketplaces. Aluminum’s low density which is one of its fundamental characteristics makes it the perfect material for a variety of uses, including transportation, building, packaging, and electrical […]

Since ancient times, silver has been sold as a valued metal. It is widely utilized throughout many different industries, such as jewellery, electronics, and photography, and is also seen as a store of value and an inflation hedge. Identical to gold, silver is also regarded as a store of value and to protect their capital […]

Before learning about VIX, let’s learn about volatility. Volatility in the security markets implies the tendency of the market to move aggressively and quickly in both directions. The Price movement can be a sharp rise or decline in a short time frame. Volatility can be caused due to increase in uncertainties and contingencies in the […]

Introduction The market doesn’t fall or rise in linear fashion, but in cycles which are symmetrical in every time frame, you observe. This bi-directional cyclical movement of securities helps traders make money from trading in derivatives. When volatility rises, the margin of movement in both directions increases, which expands the scope of profits and also […]

A lot of you must be thinking that options trading is complex and mind-boggling, to begin with. Or it could lead to losses you cannot bear. This is because most of us do not have the proper knowledge to start trading. Where it is easy to categorize something as difficult, but the trick lies in […]