Introduction

The various assets that mutual funds offer, from stocks to bonds and those in between, make them attractive investment options as they offer combinations to the investors. A mutual fund is tailor-made depending on an investor’s investment and financial goals, managed by portfolio managers, whose goal is to generate profit for these investors. There are various types of mutual funds, one being arbitrage mutual funds.

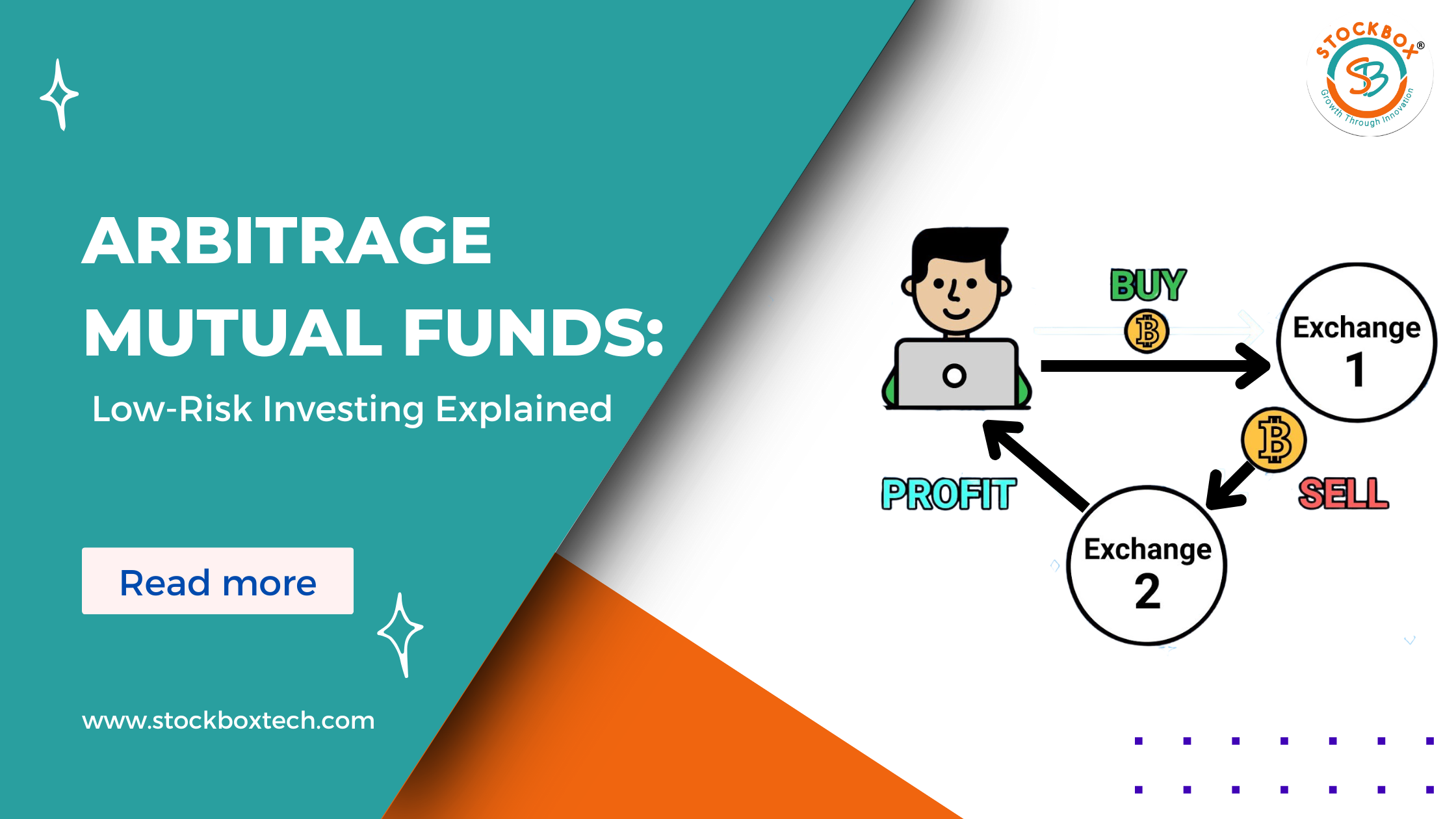

Arbitrage funds allow traders and investors to buy and sell securities in different markets, thus taking advantage of profits even from the smallest differences in price in those markets. However, investing in an arbitrage fund is not something you should plunge into without gaining some knowledge of the aspect in question about the mutual fund.

The Arbitrage Fund:

Arbitrage funds really contrast with what is usually done in a normal mutual fund in purchasing stocks and selling them subsequently after their price has appreciated. Arbitrage funds, on the other hand, target traders and investors aiming to take advantage of volatile markets but with minimum risk.

The arbitrage due to price differentials enables the investor to take practically simultaneous purchase-sell actions in different markets. The cash and futures markets are very important and popular in arbitrage funds.

Trade cash markets on stock and sell in the futures market. However, since both of these two markets are low in size, the trader must work in more trades for an entire year to realize huge profits.

Working of Arbitrage Mutual Funds

To understand the workings behind an arbitrage fund, here are two examples.

Example 1: Where there are Price Differences between Exchanges

- Suppose that the stock of company A is quoted at ₹1000/share on the stock exchange of state 1.

- On the stock exchange of state 2, the stock is being quoted at ₹1010/share.

- If the arbitrage fund manager spots such a price discrepancy, he will then buy shares on state 1’s exchange and sell them on state 2’s exchange.

- This will allow the trader to make ₹10/share without any risk.

Example 2: Where the Cash and Futures Markets Show Price Difference

- Let’s say Company A stock sells for 1000 rupees per share in the cash market.

- In the futures market, it is selling for 1015.

- If the arbitrage fund manager can spot the price difference, he would buy from the cash market and set up a contract in the futures market to sell at 1015.

- If sold in the future, the trader’s profit would amount to 15 per share and would carry very minimal risk.

Features of an Arbitrage Mutual Fund

A whole discourse regarding arbitrage funds cannot be taken up without discussing the various features. Here they are:

- Equity Oriented

An arbitrage fund, in respect of the scheme, should have about 65% of the funds exposed to equity.

- Holds Hedged Exposures

The arbitrage fund’s portfolio consists of hedged exposures.

- Low-Risk

Arbitrage funds, compared to many other kinds of mutual funds, are also usually low-risk. Arbitrage funds with low risk show good performance on a post-tax return basis compared to non-equity-oriented funds.

- Works Best in Volatile Markets

Arbitrage funds navigate themselves pretty well in a volatile market.

Benefits of Arbitrage Funds

Now that you have seen the main features and benefits of investing in arbitrage funds, we shall also give some consideration to the benefits these funds hold for the investor.

Low-Risk Investing

- One of the most paramount concerns for a trader while trading is the risk factor a security holds.

- Thus, arbitrage mutual funds are said to inherit the distinct characteristic of lesser risk as all the securities are being bought and sold.

- This method thus comes with hardly any risk, especially for long-term investments.

- In arbitrage funds, investors may also invest part of their capital in safer debt securities.

- Because these securities are usually unaffected by turbulent market conditions, they become one of the most rewarding choices for traders and investors.

- In times of market turbulence, these price differentials around the securities in the cash market and futures market obtain significance.

- In stable markets, individual stocks are not expected to diverge in terms of price.

- Where there is volatility, there are risks, but arbitrage funds enable an investor to let market volatility work in his favor without much hindrance from that risk factor.

Taxed as Equity Funds

- Even if the arbitrage fund invests in bonds, at least 65% of its portfolio is made up of equities. For this reason, being a fund hybrid, it is classified as an equity fund.

- Since the portfolio benefits from the equities, the taxation norms favor equity funds.

- These benefits allow the fund’s investors, who invest in shareholding in an arbitrage fund in excess of one year, to pay the fund’s capital gains at a lower rate than that of the regular income tax rate.

What Are Arbitrage Funds Returns?

If you want to know more about the returns generated from arbitrage mutual funds, you have come to the right place.

Returns on the work of an arbitrage fund are similar to short-term debt instruments like FDs or liquid instruments.

Further, arbitrage mutual funds with their taxation gain on equity may also beat either of these.

However, this can be a double-edged sword. Returns to the investor from the arbitrage mutual fund still remain highly unpredictable, as the market fluctuations that it takes advantage of can sometimes not be readily available.

Risks in Arbitrage Mutual Funds

The above are just a few advantages of investing in arbitrage mutual funds. As any seasoned investor is aware, these investments come with their share of risks. Here’s a short look at some of these risks:

- Most arbitrage funds have a higher expense ratio than other debt funds, simply because they must be constantly monitored and adjusted to capitalize on short-term market opportunities.

- Payoffs from arbitrage funds may be small because both cash and futures markets are relatively small, and it may take a trader an entire year of possible opportunities to generate a good return on their investment.

An investor’s capital would be in part used to purchase debt instruments to help support a portion of the arbitrage fund’s capital; some of these instruments might result in interest rate fluctuations whereby an increase in the interest rate could cause a decline in the net asset value of the arbitrage fund.”.

Who Should Invest in Arbitrage Funds?

While an investment in arbitrage funds stands out as an interesting, profitable option, this works well for those investors whose focus is on low-risk investment. Arbitrage funds suit investors who are typically looking at putting money in the short to medium term and want to substantially diversify their portfolio.

Conclusion

Should you be a trader or investor wanting to invest in a rather balanced security with respect to returns on one end and risk mitigation on the other end, arbitrage mutual funds can be a good option. Most returns on arbitrage funds come from taking advantage of price discrepancies between different markets or exchanges.

However, it is important to remember that mutual fund investments are subject to market risks, so think carefully before investing by reading through all scheme-related documents. With considerations of market conditions, tax implications, expense ratios, etc., investors will be able to make better-informed decisions.